Solar Power has developed a lot in the past decade

Ten years ago, solar had a small market and little public involvement (not to mention little government involvement). But in 2020, there’s estimated to be more than 115 gigawatts (GW) of solar power installed globally (more than all other generation technologies put together).

With the interest in this renewable energy building, many people are wondering what steps they need to take qualify for the tax incentives which they could benefit from by installing a solar system. We’ve got the answers.

What Are The South African Tax Incentives For Solar Power?

Good news! There are a few tax incentives or policies that deal directly with renewable energy (and some that especially mention solar energy).

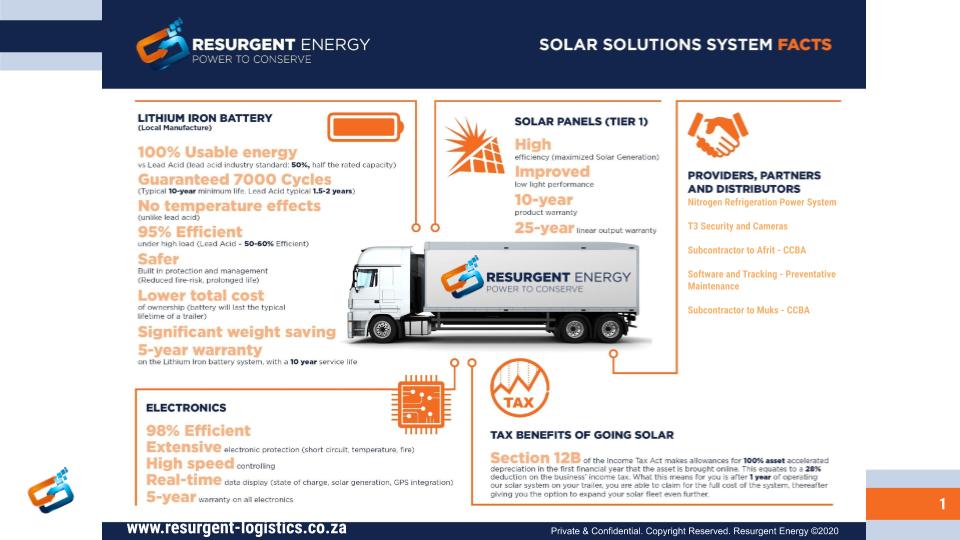

The South African government, energy regulator and Eskom have previously had several jabs aimed at them for not encouraging solar use and storage. But a recent amendment to the Income Tax Act introduces some fantastic incentives for solar power installers. The new policy allows for depreciation in the year of commissioning of the full cost of a grid-tied solar system.

In short, you can claim back the total cost (100%) of your solar installation.

The tax policy that deals with these incentives is set out in s12B(h) of the Income Tax Act, No 58 of 1962. This policy allows taxpayers to deduct the costs of a solar installation from their taxable income. Of course, as always, not everything does count as a deductible expense.

The costs that you are able to deduct for are:

- installation planning costs;

- panels delivery costs;

- installation costs; and

- installation safety officer costs.

Tax Requirements

Furthermore, for taxpayers to qualify for this incentive, they must meet three strict requirements:

- That the plant, machinery, implement, utensil or article is owned by the relevant taxpayer claiming the deduction (or purchased by it under an instalment credit agreement);

- That such plant and machinery is brought into use for the first time by that taxpayer; and

- That such plant and machinery is utilised by the taxpayer in the course of its trade in the generation of electricity from specific renewable energy resources.

If meeting these requirements, the government has stated that “a taxpayer is allowed a deduction of the costs to the taxpayer of the asset producing the electricity […] Where the photovoltaic solar energy system produces less than one megawatt of power, then the taxpayer is allowed a 100% deduction in the first year of use.”

SARS allow 100% of the cost of solar as a tax deduction incurred in the production of taxable income. In other words, only a business generating taxable income can deduct the cost against this income. Also remember that if your business is VAT registered, you can also claim the VAT back. Residential homeowners unfortunately cannot take advantage of these benefits, unless running a business from home. With this in mind, if you can save money and make money, going solar has never made more sense.